Weather continues to be unseasonally mild in the South of Ukraine, Russia, majority of Republic of Moldova, Romania, Bulgaria, Serbia…

North parts are under the snow for Ukraine and Russia and so for mountain regions of Romania, but there are no much crops growing!

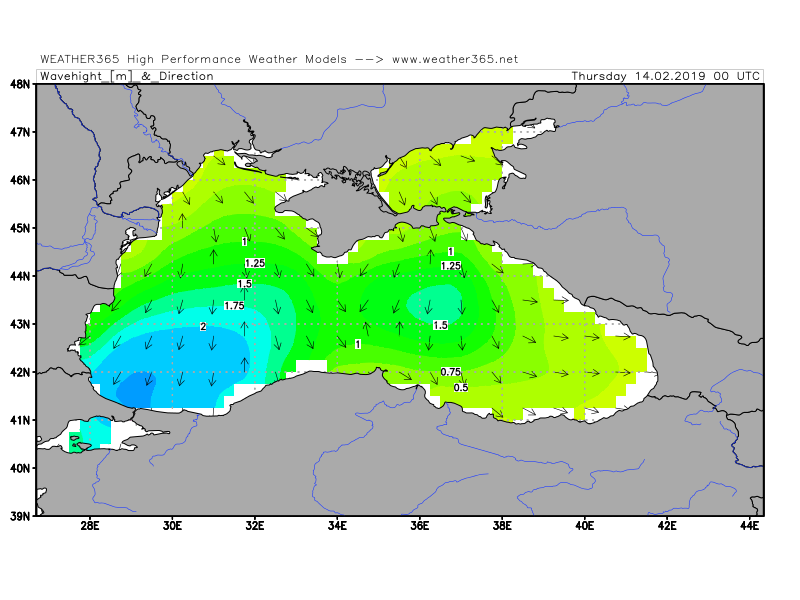

Nearby weather developments for Ukraine are following: southern wind of 7-12 meters per second, light rain in the West and North of Ukraine. Temps are 0C at the day time and minus 5C at night in the North and West of Ukraine. South is pleased with 0C at night and plus 8-9C at daytime. It is expected some wet snow and rain during Feb 13-15 in major parts of Ukraine, but not that much…the problem for loadings may remain the wind, which will be of southern direction and reach 17-20 meters per second during Feb 14-15.

With that sort of weather, what has been expected as “February windows” for planting early spring oilseeds, grains and pulses (namely rapeseeds, barley and peas) may be not validated.

On the international front – not much surprises from the last USDA report and barometer of the international seaborne economical activities – the freight index is severely down.

One source (https://www.dollarcollapse.com/ocean-shipping-rates-plunge/) has published the following at their web site, which we find useful to place here to explain the condition of panic or lack of direction as some say…

“Dry bulk shipowners face a long period of uncertainty as spot prices collapse and China shipments shrink.

A slowing global economy, coupled with weak demand from China over the Lunar New Year and from Brazil after Vale SA’s iron ore disaster, is dragging shipping rates to near record lows, and few in the industry expect things to improve any time soon.

Brokers in Singapore and London said capesize vessels, the largest ships that move bulk commodities like iron ore, coal and aluminum, were chartered in the spot market for as low as $8,200 a day on Thursday, a $500 decline from Wednesday. Break-even costs for carriers can be as high as $15,000 a day, and daily rates in the capesize market hovered above $20,000 last year.

“Everyone is looking for a catalyst to push the market up, but it’s not there,” said a Singapore broker.

The Baltic Dry Index, which tracks the cost of moving bulk commodities and is considered a leading indicator of global trade, is down more than 50% since the start of the year.

The long Lunar New Year holiday in early February is one of the slowest periods in commodities trading as factories in China, the world’s biggest importer of raw materials, shut down. But ship executives say the bulk seaborne freight business is more broadly suffering from the lowest demand in two years, while China’s trade tussle with the U.S. is making the market more volatile.

“A long slowdown in the Chinese economy will hurt commodity demand and send shipping rates sharply lower,” Bloomberg Intelligence industry analyst Rahul Kapoor said.

The Vale iron ore disaster in Brazil in January, in which a mining dam burst, triggering a flood that killed at least 150 people and left close to 200 more missing and feared dead, created a new source of uncertainty.

Vale has suspended production at a number of sites, removing 40 million tons of annual output, or 11% of the giant miner’s total production in 2017.

The reduced sailings could affect dry bulk owners, including China Cosco Bulk Shipping Co. Ltd, Norway’s Golden Ocean Group and Greece’s Diana Shipping Inc.

“The Vale void will be largely covered by iron ore shipments out of Australia,” the Singapore broker said, “but Brazil generally commands higher freight rates so there is no good news.”

China has resumed importing soybeans from the U.S., a sign of progress in talks between Washington and Beijing. But the 540,000 metric tons of shipments from the U.S. in January were less than half the monthly average last year.

“If you are a bulk owner, you can no longer depend solely on China to make money, and that’s a seismic shift,” said a London broker.»

So they say ….when it rains everyone is wet. There are the talks about China – USA deal coming. Business trusts it is coming but business may play the game into any direction – making money can be done on the no-deal or bad-deal too…same as to Brexit. Some officials say it is coming, but there may be strategy behind saying so. Analysts say its coming but who will charge analysts if that’s not? Well, when everyone is that concerned it is coming – we feel differently.

GRAIN MARKET VALUES

Wheat:

|

Handy and Panama size vessels |

Feed wheat: Sellers for feed wheat at COY port(s) were showing $225 DAP for February shipment vs $222 payable by multinational houses and their local rivals. FOB is calculated out of that as $235-236 and that was very close to where milling wheat has been recently offered. The bids for 11.5% protein wheat were just USD 3-4 higher than the feed variety sells itself. |

|

Coasters |

No news here. |

|

Containers |

Moldovan feed wheat was indicated at $227 FAS Odessa for Feb/March and Moldovan 11.5% protein wheat has been indicated at $235 FAS Odessa for Feb/March. Moldovan feed wheat has been shown at $265 CIF port Klang, Malaysia. Philippines bids were on or below $270 for only Ukrainian feed wheat with 10-10.5% protein for March shipment. |

Coarse Grains

|

Handy and Panama size |

Corn: Sellers ask $186-187 FOB COY port(s) but there is not much buying interest around for maize. There are good and going better crops down in Argentina (45 MMT vs 43 MMT previously) and Ukrainian exports increased at the record phase, so market feels no hungry. One of our clients in Malaysia says they’re buying South American corn at around $207-208 CNF for April, May, June …a hold-two from the panamax….so with $186 or even $184 …fob in Ukraine for handy size, that origin can go smoke for some time, at least as far as South Eastern Asia is concerned. Philippines has their own corn crop growing and being cut for Feb/March with local prices selling PHP 16000 a ton. That is an equivalent of any origin corn of around $242 CNF….and the importers shopping Myanmar corn which is ASEAN origin and goes at just 5% tariff (other origins are with 50% or so) into Philippines was indicated at $255 recently and that was also considered high. Thailand and Vietnam corn offers were either absent or too high ….as local consumption pays better. |

|

Coasters |

Moldovan maize was indicated at $182 FOB Reni for early March shipment. |

|

Containers |

Moldovan corn was indicated at $215 CNF Malaysia with buyers’ vision of price at around $198-197 there… |

Oilseeds & Oils:

Offers for sunseeds to Marmara Sea ports were $391 CIF for March shipment from Moldova and Turkish crushers were looking to pay $386 in shallah. There were few Russian offers for sun seeds at $386-388 CNF. There was interest from Constanta port at $360 DAP, looking for Romanian sun seeds mainly and Romanian farmers were asking for $360 ex-farm. Farmers’ value grew like $12 a ton for the last week….targeting $15 and even at those levels farmers are keen to “better wait then sell”. Some people expect $400-402 to be traded soon for Moldovan sun seeds for Marmara for March/April as Turkish crushers are keen to take more, even though not keen to price it better so far.

Oil meals & Proteins:

|

Coasters |

Wheat bran pellets: Nominal values were of around $170 CIF Marmara Sea for Feb/March shipment, black sea origin. Trades happened at low $170-s for Izmir for LH Feb / FH March shipment.

Tapioca residue pellets: Thai product (30-35K) was indicated at $165 CIF Turkish ports for March shipment. Buyers were now saying “below $120-s” should be the value….which simply means no interest for that material.

Palm Kernel Expellers: Some volumes were indicated at low $130-s levels for Turkey for Feb and buying interest was below $115-level for March/April, while February has been bought at $119 CIF.

Sugar beet pulp pellets: Turkish Marmara pays $209-210 CIF for Russian sugar beet pulp pellets for Feb/March shipment. Few trades were done at those levels, but no wild demand. Market is awaiting for Egyptian prices soon…for March/April.

Sunflower meal: FOB Kherson was indicated at $215 for Feb/March shipment for min 35% pro non pelletized stuff. CIF Marmara has been offered at $239 for min 35% pro meal vs buyers at $235. March shipment optional origin 35% min pellets offered at $241 cif Marmara.

|

|

Containers |

Dead trade thanks to Lunar New Year in China and Vietnam …and overall around where Chinese-speaking communities were interested to BUY…before! |

Pulses:

Peas

There are the reports from India that two vessels and more than 4000 containers (that includes black matpe, green mung and pigeon peas) were stuck in Indian ports and may not be cleared at all as Government took a hard line against the importers who used the Chennai court orders …to import the goods at the era of ban.

Pyramid has collapsed leaving some Singapore and Dubai traders affected.

Pakistan was bidding low-to-mid $280-s but that’s nominal. There are buyers at $277-278…but so far no sellers, however there were some re-directed cargoes from India (underway to India) that landed in Karachi and the market feels heavy…so either it has to be cheaper or no deal.

Local prices lost some $5 to $7 a ton in Ukraine but no farmer have sold much at those levels. And question is where to move it? It counts no more good for feed markets in Europe but it counts no better for container markets in Indian subcontinent. And there are simply no more other markets available at the moment, except possibly local splitting industries that will soon be burning their fingers as demand is slipping away.

Chick peas

Russian chick peas (Kabulis) were indicated at $440 CNF Karachi for March vs $415 buyer. There were times when buyers were hot for chick peas, but now the hotter temperatures are coming into India / Pakistan / Persian Gulf countries and Kabulis are not that much consumed as during the colder periods.

Consumer behavior changing dramatically in Asia

Consumer behavior changing dramatically in Asia  Raising this species of flies and then taking the eggs to sell for 3 million VND / 100 grams of fly eggs

Raising this species of flies and then taking the eggs to sell for 3 million VND / 100 grams of fly eggs  Poland: Poultry feed production hampered by Covid-19

Poland: Poultry feed production hampered by Covid-19  How to slow pig growth due to Covid-19?

How to slow pig growth due to Covid-19?  June feed update: What did you miss?

June feed update: What did you miss?  Good weather in the US slightly reduces soy price

Good weather in the US slightly reduces soy price PTT Trading Service Co., Ltd

(Vietnam Address)

462, Pham Thai Buong Street,

(R3-37 My Toan 1 - H4), Phu My Hung,

Tan Phong Ward, District 7,

Ho Chi Minh City, Vietnam

Tel: (+84) 286 6868 5888

Singapore Office:

Blk 457, Pasir Ris Drive 4, #09-305

Singapore 510457

Contact: (+84) 903 077 931

Email: jeffreypang@pttgroup.org